In a previous post I talked about how you can order and pay for masks online using an e-reader and your NHI card. You can also pay your taxes using your NHI card. If you ordered masks using the system, you’ve already set up your NHI card for use and you can skip this post. If you didn’t you’ll need an ATM-style card reader and some patience.

(Note: If you’re about to renew your ARC, plan to do your taxes before the renewal or after, as your details may not be accepted while your renewal is being processed, according to NihaosItGoing.)

(You can also use your Alien Citizen Digital Certificate if you have one, and the process will be exactly the same except you will be asked to enter your pin).

First things first: Install your card reader

After you’ve installed the card reader, head to their website, if you’re a Windows user, you’ll need to download their Windows installer, or MAC Installer, (others available here). You can check if your card is being read properly here.

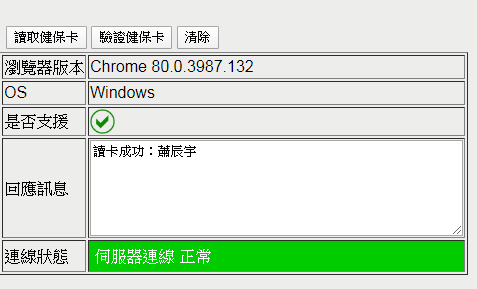

If it’s working, you should get a message like this:

You’ll also have to mark your server as a trusted server on this page). You’ll have to be an administrator on your computer to do this.

First-time users should click the box labeled 「首次登入請先申請」(First-time users, please apply here first), which I’ve marked with a red box below:

(Note they’ve now added English to the website too.)

This will take you to a list of terms that you can click agree on:

At the minute it seems like the NHI have added an extra security precaution so that you have to enter your 「戶號」. However, if you press 「讀卡」 (read card) on this screen, it should take you to the page below, where you’re prompted to fill in your ARC details (on an ARC owned by the Vietnamese spouse of a Taiwanese person apparently):

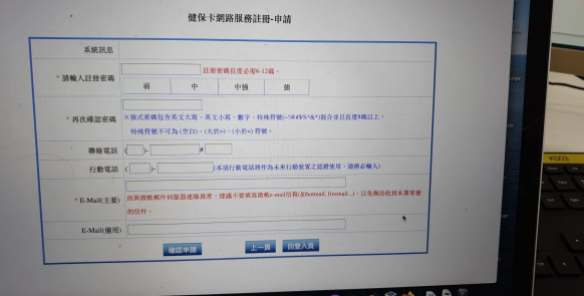

That should take you to a screen like this where you set your password:

After this you’ll have to confirm your email address:

Expect to get quite frustrated with your card reader throughout this process.

Once you’ve registered your email, and verified it and set your password you’re ready to use your NHI card for to file your taxes.

First go to this website:

File Offline Then Upload (PC Windows Users Have to Choose This)

And click the turquoise button to file your taxes offline and then upload them or the dark blue button (Web線上版) to file your taxes online.

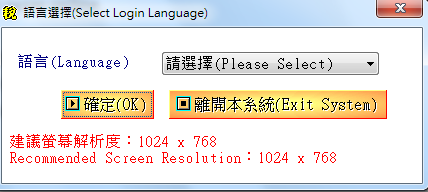

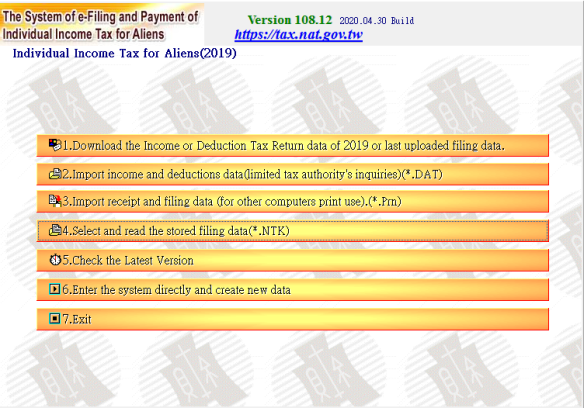

If you chose offline, you’ll get a program downloaded on to your computer. Once you open it, you get asked if you want to proceed in English or Chinese. The advantages of English is that it’s quicker to read, but the advantages of Chinese is that it matches all the jargon on your documents:

Then it will check a few more things and you can just click 「確認」 or “Confirm”. It will also ask you if you want to check for the latest version. Unless you already had it on your computer, you can just say “no” and proceed at this point.

If you get an error at this point telling you that today’s date is not valid, visit my troubleshoot post here.

Next it will ask you what year you want to file for – this should be 108 or 2019, depending on format and you should choose Taxpayer.

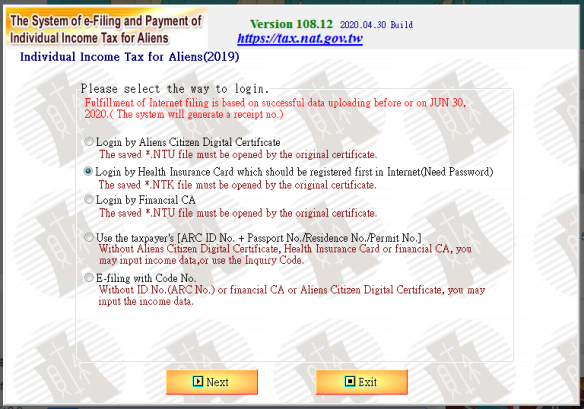

The next screen will ask you how you want to login. (You can login with just your ARC number, but this means that you’ll have to enter all the data yourself.) So if you’ve got your card-reader fired up, stick in your NHI card and choose NHI card and password:

Next you’ll be prompted to enter your ARC number. After that the following screen will up and you should choose the first option (to download info on tax withholding and deductions):

(If you just have your ARC, you can click 6 here and begin entering your data manually.)

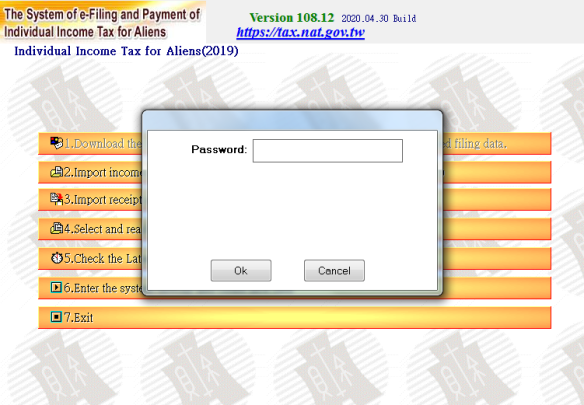

For those with card readers and NHI cards, you’ll be prompted to enter a password. This is the password that you used when setting up your NHI account above. (It’s also the password you have to enter on your NHI app every time you login:

You’ll get a few more intermediary screens saying that the info is just for reference. Including two report previews which you can read and then close to proceed.

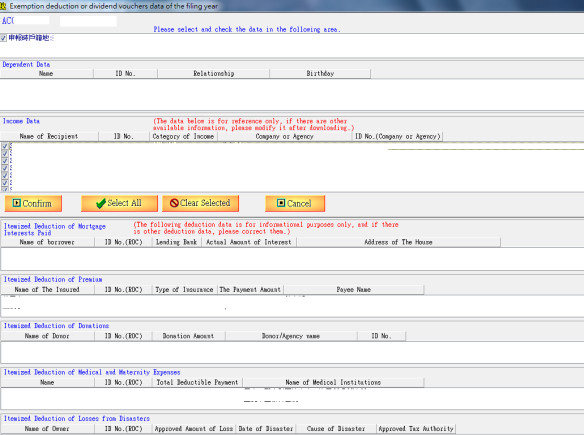

You’ll then get to the list of deductions and the withholding information, which should look something like this, but with data filled in:

This is a list of all your income, including salary and bank interest, and below is a list of different kinds of deductions. If you’re satisfied you can select all and confirm.

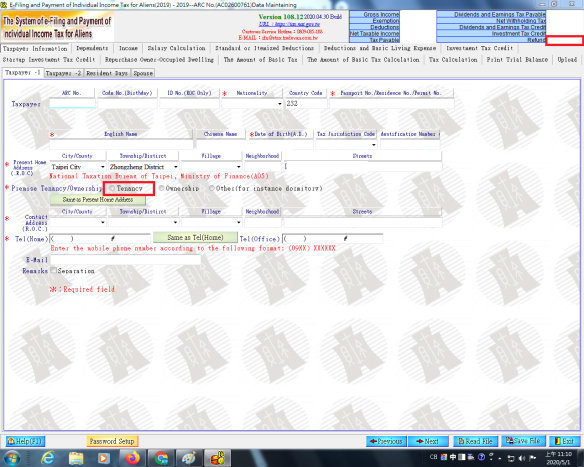

Now you come to the tax form proper:

You should see your income info and refund listed in the top right corner. The rest of the information you’ll have to fill out yourself.

The next sections are reasonably straightforward, and most of the info is auto-filled or blank. Unless you have a spouse and are filing together or dependents.

You can go for itemized deductions if your itemized deduction is above NT$120,000, which is the standard deduction, on the deduction page.

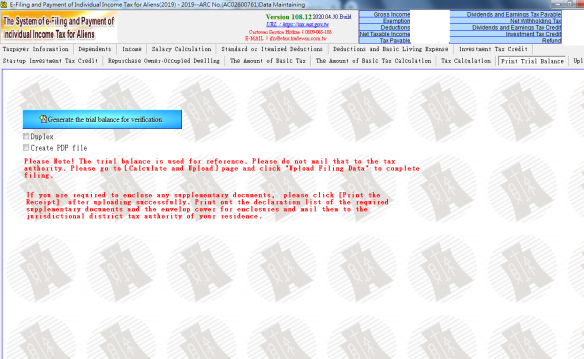

If you’re on your way to your APRC, make sure to print the statement, here. As you’ll have to mail in a copy to get your certificate:

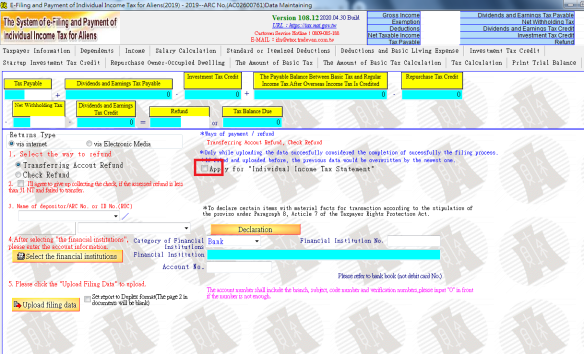

Next you pick how you’ll get your refund and if you want to apply for the tax statement, make sure to tick the box:

You can choose check or bank transfer, I suggest the latter (you’ll have to fill out your bank identifier number and your account number then you can “Upload filing data”.

Remember to print the docs or save them to print later, if you want to apply for a tax certificate. You’ll have to mail a copy of your tax filing and then the certificate will be mailed to you!

File Online (Mac and Linux Users)

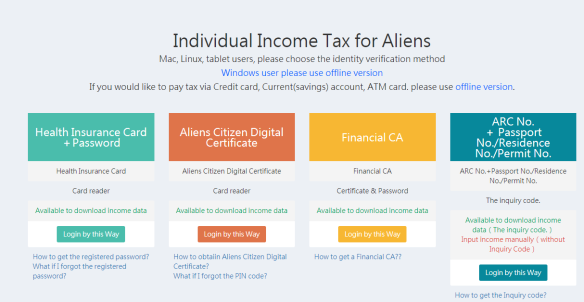

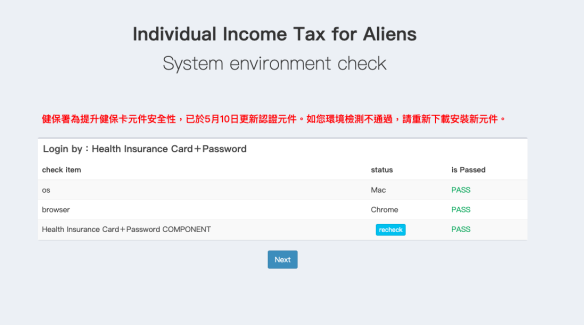

If you chose online, it should take you to this screen and you can choose the NHI Health Card and password option:

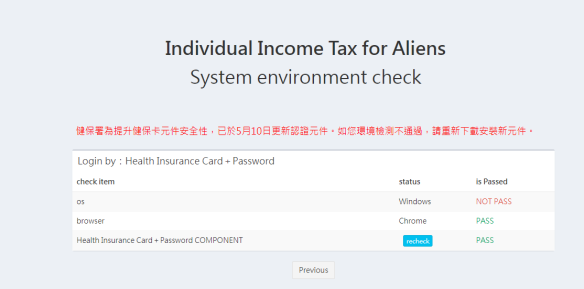

If you’ve got everything set up and you get this message:

This is because you’re using a Windows system, so you’ll need to use the offline method described above.

There is a message in Chinese saying that they’ve updated the systems on May 10 (the future), so you need to download the new component. Maybe this will change the game in terms of Windows users? *shrugs*

So I used the online system successfully on a Mac this evening:

After this it is essentially the same process as the offline version for Windows.